Saudi Arabia’s Role in the Petrodollar System

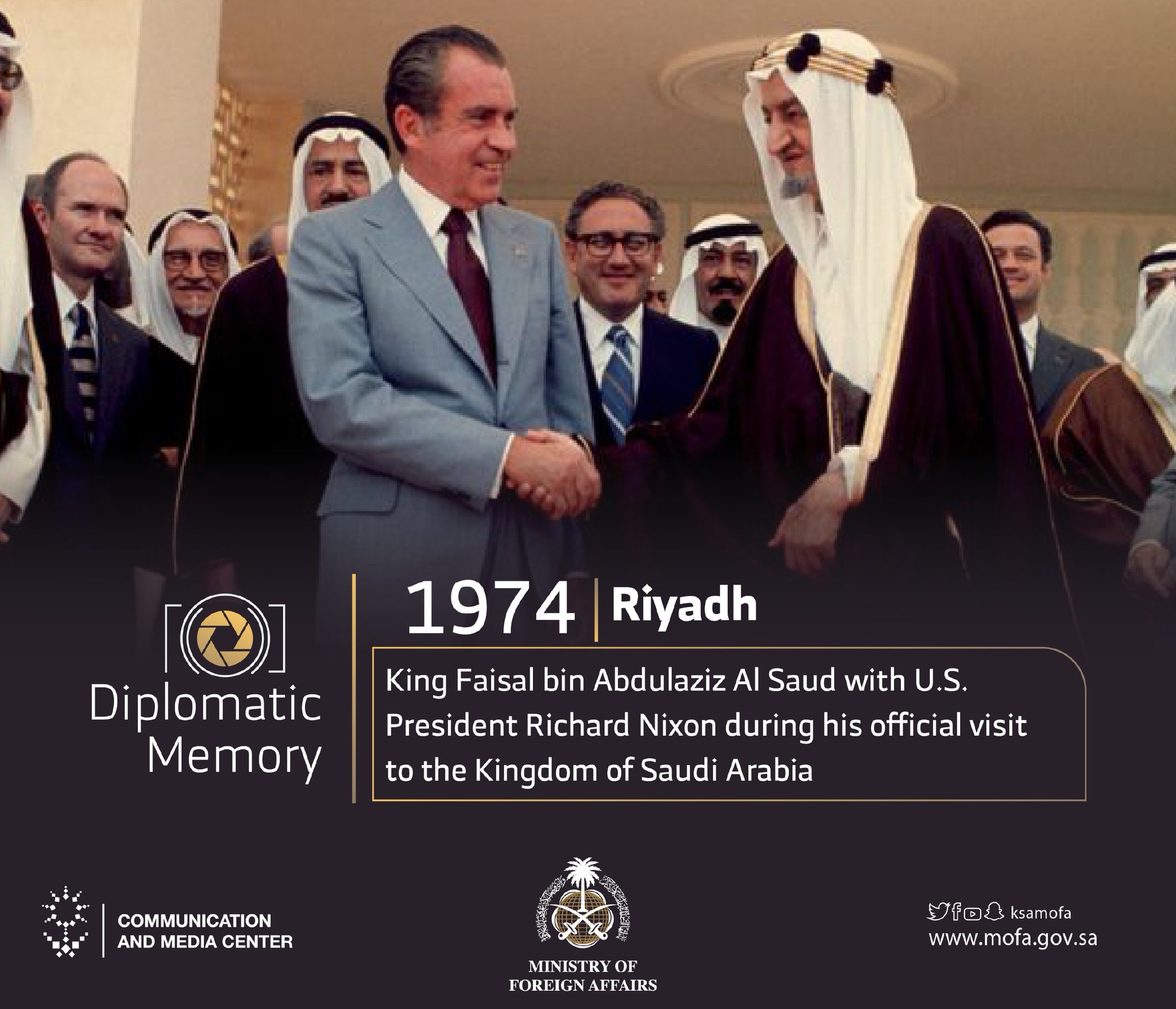

Petro dollar saudi arabia – The petrodollar system is a global financial arrangement that emerged in the 1970s, in which oil is priced and traded in US dollars. Saudi Arabia played a pivotal role in the establishment and maintenance of this system.

The petrodollar system, anchored by Saudi Arabia’s oil wealth, has been a topic of discussion lately. Amidst the murmurs of its potential demise, another rumor has emerged: the possible trade of basketball superstar Steph Curry. While the validity of these steph curry trade rumors remains uncertain, they serve as a reminder of the interconnectedness of global events.

The fate of the petrodollar system could have far-reaching implications, not just for Saudi Arabia but for the entire world.

In 1973, the Organization of the Petroleum Exporting Countries (OPEC) announced that it would only accept payment for oil in US dollars. This decision was made in response to the devaluation of the US dollar following the collapse of the Bretton Woods system. By insisting on payment in dollars, OPEC effectively linked the value of oil to the US dollar.

The petrodollar system, a linchpin of Saudi Arabia’s economy, has been a subject of intense debate. Amidst these discussions, one name that often arises is Bob Gibson , a renowned baseball player. Gibson’s influence extends beyond the diamond, as his insights into the petrodollar system have shed light on its complexities.

Returning to the topic at hand, the petrodollar system continues to shape Saudi Arabia’s economic trajectory.

Saudi Arabia, as the world’s largest oil exporter, played a key role in this decision. The Saudi government agreed to peg the Saudi riyal to the US dollar, ensuring that the value of oil would remain stable in relation to the US currency.

The petrodollar system, a cornerstone of Saudi Arabia’s economy, has been a subject of much debate. It’s worth noting that even in the realm of sports, iconic figures like Rickey Henderson , renowned for his base-stealing prowess, have made their mark.

As the petrodollar system continues to shape global economics, it remains a fascinating topic for both experts and enthusiasts alike.

Economic Benefits

Saudi Arabia has derived significant economic benefits from its participation in the petrodollar system. The high demand for oil in the post-war era led to a surge in oil prices, which in turn resulted in a massive influx of petrodollars into Saudi Arabia.

The petrodollar, a financial arrangement between the United States and Saudi Arabia, has shaped global economics for decades. It’s intriguing to learn about the complexities of international relations, isn’t it? Did you know that Anthony Starr , known for his captivating performance in The Boys, is 46 years old?

Such fascinating tidbits enhance our understanding of the world. Returning to the petrodollar, its impact on Saudi Arabia’s economy is undeniable.

This wealth has allowed Saudi Arabia to invest heavily in its infrastructure, education, and healthcare systems. It has also enabled the country to accumulate vast foreign exchange reserves.

Political Benefits

In addition to economic benefits, Saudi Arabia has also gained significant political benefits from its role in the petrodollar system. The US government has been keen to maintain close ties with Saudi Arabia in order to ensure the stability of the petrodollar system.

This has given Saudi Arabia a degree of influence over US foreign policy. For example, Saudi Arabia has used its petrodollar wealth to lobby the US government on issues such as the Arab-Israeli conflict and the war in Iraq.

Examples of Influence

There are numerous examples of how Saudi Arabia has used its petrodollar wealth to influence global events. For example, in the 1970s, Saudi Arabia used its oil embargo to pressure the US government to support Israel in the Yom Kippur War.

More recently, Saudi Arabia has used its financial clout to lobby the US government against the Iran nuclear deal.

The Impact of the Petrodollar System on Saudi Arabia

The petrodollar system has had a profound impact on Saudi Arabia’s economic development. The country’s oil wealth has allowed it to invest heavily in infrastructure, education, and healthcare, leading to significant improvements in living standards. However, the petrodollar economy has also had some negative social and environmental consequences, including income inequality, environmental pollution, and a lack of economic diversification.

Economic Development, Petro dollar saudi arabia

The petrodollar system has been a major driver of Saudi Arabia’s economic development. The country’s oil wealth has allowed it to invest heavily in infrastructure, education, and healthcare. This has led to significant improvements in living standards, with Saudis enjoying access to modern healthcare, education, and transportation systems. The petrodollar economy has also helped to create a large middle class and a growing private sector.

Social and Environmental Consequences

The petrodollar economy has also had some negative social and environmental consequences. The rapid influx of oil wealth has led to income inequality, with a small elite benefiting disproportionately from the country’s oil wealth. The petrodollar economy has also contributed to environmental pollution, with the country’s oil industry being a major source of greenhouse gases. Additionally, the lack of economic diversification has made Saudi Arabia vulnerable to fluctuations in the oil market.

Challenges and Opportunities

Saudi Arabia faces a number of challenges as it seeks to diversify its economy away from oil. The country’s dependence on oil has led to a lack of economic diversification, with the non-oil sector accounting for only a small share of GDP. This has made Saudi Arabia vulnerable to fluctuations in the oil market. Additionally, the country’s large public sector and generous welfare system have created a disincentive for Saudis to work in the private sector. Despite these challenges, Saudi Arabia has a number of opportunities to diversify its economy. The country has a large and well-educated workforce, as well as a number of non-oil sectors with potential for growth, such as tourism, financial services, and manufacturing.

The Future of the Petrodollar System and Saudi Arabia: Petro Dollar Saudi Arabia

The petrodollar system, which has been in place since the 1970s, has been facing increasing challenges in recent years. The rise of alternative energy sources, the growing influence of non-dollar currencies, and the geopolitical shifts in the Middle East are all putting pressure on the system.

Factors Driving Challenges to the Petrodollar System

* Diversification of energy sources: The increasing availability of renewable energy sources, such as solar and wind power, is reducing the world’s dependence on oil. This is making it less necessary for countries to hold large amounts of US dollars to purchase oil.

* Growth of non-dollar currencies: The euro, the Chinese yuan, and other currencies are becoming increasingly important in international trade. This is reducing the dominance of the US dollar and making it less necessary for countries to hold US dollars as reserves.

* Geopolitical shifts: The rise of China and other emerging economies is changing the global balance of power. This is leading to a shift away from the US-dominated world order that has been in place since the end of World War II.

Potential Implications for Saudi Arabia

A weakening petrodollar system could have significant implications for Saudi Arabia, which relies heavily on oil exports for its revenue. If the demand for oil declines or if the price of oil falls, Saudi Arabia’s economy could be severely impacted.

Alternative Scenarios for the Future

There are a number of possible scenarios for the future of the petrodollar system. One possibility is that the system will continue to weaken, leading to a decline in the value of the US dollar and a shift away from oil as the world’s primary energy source. Another possibility is that the system will adapt to the changing global landscape, with the US dollar remaining the dominant currency for international trade but with a reduced role for oil.

The petrodollar system, where oil is traded in US dollars, has been a cornerstone of Saudi Arabia’s economy for decades. However, the emergence of digital currencies and alternative payment systems could potentially challenge its dominance. In this context, it’s worth noting the rise of Anthony Starr , an actor known for his portrayal of Homelander in the popular television series The Boys.

While his personal life and career may not seem directly related to the petrodollar system, the global reach and influence of the entertainment industry cannot be ignored. As the world continues to evolve, it remains to be seen how these seemingly disparate threads will intersect and shape the future of the petrodollar system.